Hey guys. Just to expand on my previous comment about natural built-in incentives instead of forced locks.

For another project I and another guy I work with designed a mechanism which I called “Personal Rewards Curve” and which goes into this direction. I can use this concept to showcase my way of thinking and what exactly I mean.

So, the curve is individual to every user and defines the amount of rewards a user will receive. A user “proceeds” on this curve the longer he does not withdraw provided liquidity. The further the user is on the curve the more rewards he will get. The general idea here is to incentivize longer term liquidity provision and create a game theoretical system around it.

There are probably alternative implementation possibilities of this idea. There’s also a question whether it should be deterministic (ending at date x) or flexible. A flexible approach could be the following: You set aside a fixed amount of tokens for baseline rewards (rewards that every user earns no matter what, lower % of total tokens) and a fixed amount of rewards for the personal curve (higher % amount of total tokens). Now you set a minimum length of the incentives for the curve, e.g. 6 months. Afterwards, you set the timeframe when a user would receive maximum rewards, let’s say he does so if he doesn’t withdraw from his LP position for 90 days. The program would only run for 6 months if every LP fully utilizes the curve (keeps deposits in for 90 days), which is unrealistic. Now a user earns his rewards regularly and they are calculated by taking the user’s baseline rewards + the curve rewards. The curve rewards depend on his share of the total TVL and how long he did not withdraw his liquidity for. Let’s say he owns 10% of the pool. If this user is at the end of his personal rewards curve he will be eligible for 10% of the total curve rewards for this period of time. If the personal curve would be linear, he would only receive 50% of this 10% if he didn’t withdraw for 45 days. Obviously, the curve can be played with and linear may not result in the biggest incentives. Having bigger rewards kick in after only 30 days for example could be interesting. The rewards each month would simply be total % of tokens allocated to the curve rewards / chosen time frame for reward period. E.g. 10% of total supply for 10 months => 1% each month.

Now with the above system, there would be tokens that actually weren’t given out to users as they didn’t utilize their curve. If a user only left in liquidity for 45 days, he will not be eligible for the full rewards. The remaining 50% of his due share can now be put back into the liquidity pool to extend the program. All “leftover” tokens will result in the curve program to be extended.

If I left my liquidity in for 90 days to earn the full rewards and withdraw my provided liquidity now the curve will reset and I would have to deposit for 90 consecutive days to reach this point of the curve again.

A deterministic approach would be to burn these leftover tokens and choose an ending date for the incentive program.

As a quick side note, to link it to the token I also recommend to add that you are not allowed to harvest your earned rewards. Technically harvesting often triggers a withdrawal and therefore also resets the curve. Linking it to the token makes the psychological play even more interesting. Do I harvest at the current price but reset my curve? Am I in it for the short-term or the long-term? Etc. These decisions will be individual to every user, therefore there are no built-in bottlenecks of token releases or general selling pressure.

Now there are some interesting edge cases that need to be considered but that will totally depend on individual implementation. This for example includes: What if a user doesn’t withdraw his full liquidity (e.g. only 15% or so), should the curve fully reset? Should it only reset for this portion of the liquidity? Also, if a user deposits more funds it should start at 0 again for this amount. Can the curve progress be transferable to a different wallet? Can it be tied to for example an NFT? If yes, the curve position will actually have value on the secondary market but people can buy a “boost” without actually depositing for 90 days. Just thinking out loud here, like I said that depends on actual implementation and a lot is possible.

To summarize, this has several advantages:

-

Early liquidity providers can achieve the exponential part of the curve quicker and are rewarded for taking higher risk early on.

-

Long-term liquidity providers are key to the success rewarded accordingly.

-

The decision whether to withdraw stablecoins for an alternative opportunity on the market will not be a short-term decision anymore as this would reset the curve. The longer people have committed in the past already the more stickiness we will achieve with this structure.

-

Punishments over vestings. Token vesting structures often have a negative impact on the sentiment of investors, the price of unlocks and trader sentiment. Creating incentive structures which reward longer-term commitment but offer full flexibility is a more promising alternative.

All in all, I think it’s quite the interesting structure. Main question will be whether added complexity, risk and development work is worth it.

Personally, I would find something like this way more interesting though than a forced lock up with unknown performance of the LP token’s underlying assets. E.g. Hegic LPs lost a lot of money by LPing. Imagine being forced into that for 84 days.

If anything isn’t clear let me know and I will try to explain it better.

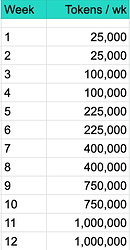

… charts are good.

… charts are good.